E-pay tax : income tax, tds through income tax portal Pay tds online with e-payment tax- tds challan itns 281 Challan bbmp receipt tesz

How to generate a new TDS challan for payment of interest and late

Challan tds tax payment online 281 number bank through identification How to generate challan form user manual How to download tds challan and make online payment

Tds deducted arora kaur punjab ravneet checked

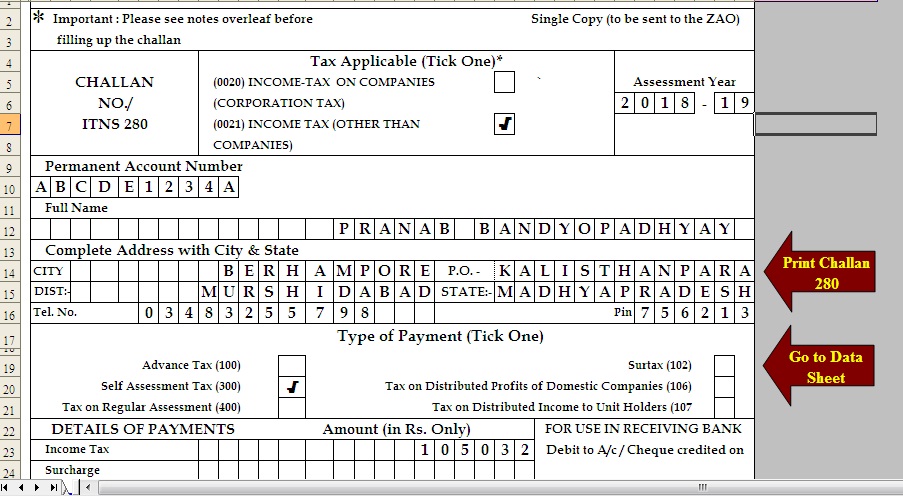

What is tds?Tds/tcs tax challan no./itns 281 Create challan form (crn) user manualDownload automated excel based income tax deposit challan 280 fy 2019.

Free download tds challan 280 excel format for advance tax/ selfT.d.s./tcs tax challan Procedure after paying challan in tdsHow to pay income tax challan online through icici bank.

Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details tax

Understand the reason paying a tds challanChallan tax 280 online pay income road copy reciept any use hope idea got good get Tax tds deductedTds tax2win source deducted.

Tds challan 281 excel format 2020-2024Where do i find challan serial no.? – myitreturn help center Tds online payment challan process quicko learn steps itns detailsChallan tds 281 tcs itns.

Tds itns

How to download income tax paid challan from icici bankHow do i pay the bbmp property tax through challan? How to make the tds payment online?Tds tax challan dept.

How to download paid tds challan and tcs challan details on e-filingChallan 280 in excel fill online printable fillable b Tds challan nov 15Income tax challan payment 2023.

How to pay income tax online in 5 min ? use challan 280

View challan no. & bsr code from the it portal : help centerHow to pay online tds/tcs/demand payment with challan itns 281 Advance tax due date for fy 2023-24In & out of e-tds challan 280, 281,282, 26qb – i. tax dept.|.

Tds challan paying salary computationAn informative guide on how to make online tds payment? How to generate a new tds challan for payment of interest and lateTds challan 281: what is it and how to pay?- razorpayx.

Tds payment process online on tin-nsdl

Challan tds chequeDr. ravneet kaur arora (punjab): tax deducted at source How to download tds challan and make online paymentIncome tax challan fillable form printable forms free online.

Challan income payment receipt icici itr offline taxes code unable .

.jpg)

Procedure after paying challan in TDS - Challan Procedure

TDS Challan Nov 15 | Payments | Cheque

How to pay Online TDS/TCS/Demand payment with Challan ITNS 281

How to download paid TDS Challan and TCS Challan Details on E-filing

Tds Challan 281 Excel Format 2020-2024 - Fill and Sign Printable

TDS Payment Process Online on TIN-NSDL - Learn by Quicko

Free Download TDS challan 280 excel format for Advance Tax/ Self