How to pay advance tax Challan tds tax payment 280 online 281 bank number through How to pay income tax challan online through icici bank

How to Pay Income Tax that is due? | Income, Income tax, Online income

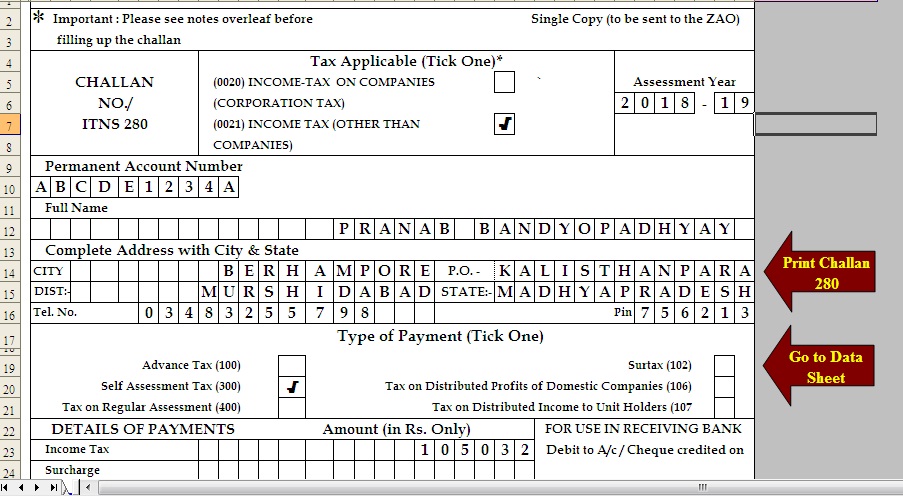

Advance tax challan pay verify online steps easy Challan signnow excel Challan 280: online & offline i-t payment for self-assessment

Challan tax counterfoil income payment online taxpayer quicko learn assessment self

How to pay income tax online or deposit challan at banksHow to pay advance tax online? (challan 280) Challan form (1)P tax challan format.

Pay your advance tax online in 5 easy stepsTds challan 280, 281 for online tds payment Challan quickoChallan 280 pdf editable: complete with ease.

Advance tax: details,what, how, why

Tax advance online challan pay payment steps easyChallan tax jagoinvestor paying interest reciept Income challan receipt taxpayer bsr cleartaxProfessional tax challan pdf fill online printable fillable blank.

Advance tax payment penalties wanted everything know option choose details other makeView client details (by eris) > user manual How to payment advance tax /income tax /self assessement tax ( challanChallan income deposit.

How to fill challan 280 offline & payment of income tax

How to pay income tax through challan 280Pay your advance tax online in 5 easy steps Tax advance challan pay online steps easy detailsIncome salaried employee section.

Icici challanAdvance electric vehicle challan Income tax challan fillable form printable forms free onlineHow to pay advance tax income tax using 280 challan.

Pay your advance tax online in 5 easy steps

Online income tax payment challansEverything you wanted to know about advance tax and penalties under it Challan cleartaxHow to pay advance income tax online for salaried employee.

How to pay income tax that is due?Challan 280 income assessment offline nsdl Reprint p tax challan with grn numberHow to pay advance tax.

Download automated excel based income tax deposit challan 280 fy 2019

Challan no. itns 281 tax deduction accountFree download tds challan 280 excel format for advance tax/ self Challan income payment receipt icici itr offline taxes code unableChallan 280 : self assessment & advanced tax payment.

Pay your advance tax online in 5 easy stepsChallan tax number professional print reprint grn Challan tax income 280 payment fill offlineHow to pay income tax online : credit card payment is recommended to.

How to pay income tax offline

Challan tax income excel deposit fy ay automated based itns .

.

How to pay Income Tax through Challan 280

How to Pay Income Tax that is due? | Income, Income tax, Online income

Everything you wanted to know about Advance Tax and Penalties under it

How To Pay Income Tax Online : Credit card payment is recommended to

View Client Details (by ERIs) > User Manual | Income Tax Department

CHALLAN NO. ITNS 281 Tax Deduction Account | Payments | Debit Card