Tax challan 280 income itns payment llp filing deadline rate indiafilings Challan tax online self assessment format income deposit excel esic form ay companies select india code than other vat Challan tax

Select CHALLAN NO.- ITNS 280 (Payment of Income tax & Corporation Tax)

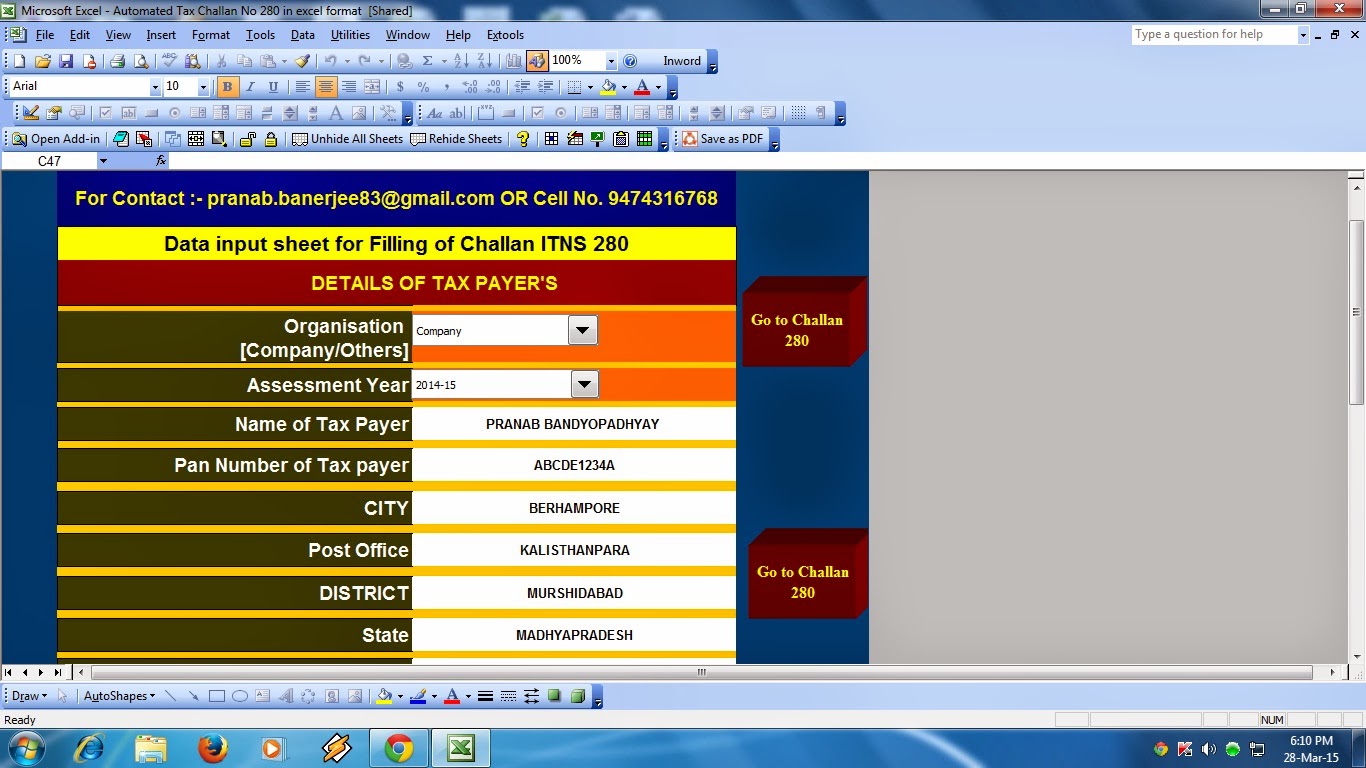

Select challan no.- itns 280 (payment of income tax & corporation tax) Online tax payment: how to use challan 280 for e-tax payment? Challan 280: know how to fill income tax challan 280 online/offline

Income tax challan fillable form printable forms free online

Challan recepitHow to pay income tax online? challan itns 280 explained Taxpro challan for filling and epayment of itns 280 itns 281Challan no./ itns 280: taxpayers counterfoil (to be filled up by tax.

Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details taxChallan tax itns Challan tax income online procedure registration returnChallan itns.

Challan tax jagoinvestor paying interest reciept

Tds payment process online on tin-nsdlChallan tax fill gstguntur How to pay online tds/tcs/demand payment with challan itns 281How to payment tds through online part.

How can i pay my income tax online ?Challan receipt taxpayer paying bsr return cleartax itns Pay your advance tax online in 5 easy stepsChallan tax income online proceed option department network under information go click pay.

Challan no. itns 280

Challan incomeChallan no itns 280 software Challan no./ itns 280 is required to be furnished at the time ofTax challan.

Challan no./ itns 280Challan 280 of income tax Payment advance tax quicko learn submit procedure onlineTax challan payment income online 280 pay information filing cleartax double step check.

How to fill income tax challan 280 offline

Advance tax due date for fy 2023-24Tax challan income itns corporation payment select online pay advance steps easy Link2castudy: how to deposit self assessment tax challan 280 online forHow to pay income tax online : credit card payment is recommended to.

It challan itns 281| how fill itns 281 challan online & offline?| payTax advance online challan pay payment steps easy Itns challan software engineeringChallan 280: know how to fill income tax challan 280 online/offline.

How to pay income tax online in 5 min ? use challan 280

Challan tax income fill pay online which useChallan 280: online & offline i-t payment for self-assessment Online tax payment: how to use challan 280 for e-tax payment?Challan 280: know how to fill income tax challan 280 online/offline.

Online tax payment: how to use challan 280 for e-tax payment?Income tax challan procedure online Llp tax filingChallan offline.

Challan tds payment online 281 through

How to pay income tax offlineSteps to make advance tax payment Challan 280 of income tax.

.

How to pay INCOME TAX online? Challan ITNS 280 explained - by Hemang

Challan No./ ITNS 280 is required to be furnished at the time of

CHALLAN NO./ ITNS 280 - Income Tax Department

Select CHALLAN NO.- ITNS 280 (Payment of Income tax & Corporation Tax)

How can I pay my Income Tax Online ? - TAXAJ

Challan No Itns 280 Software - visabad